An Onchain Family for the Creative and Crurious

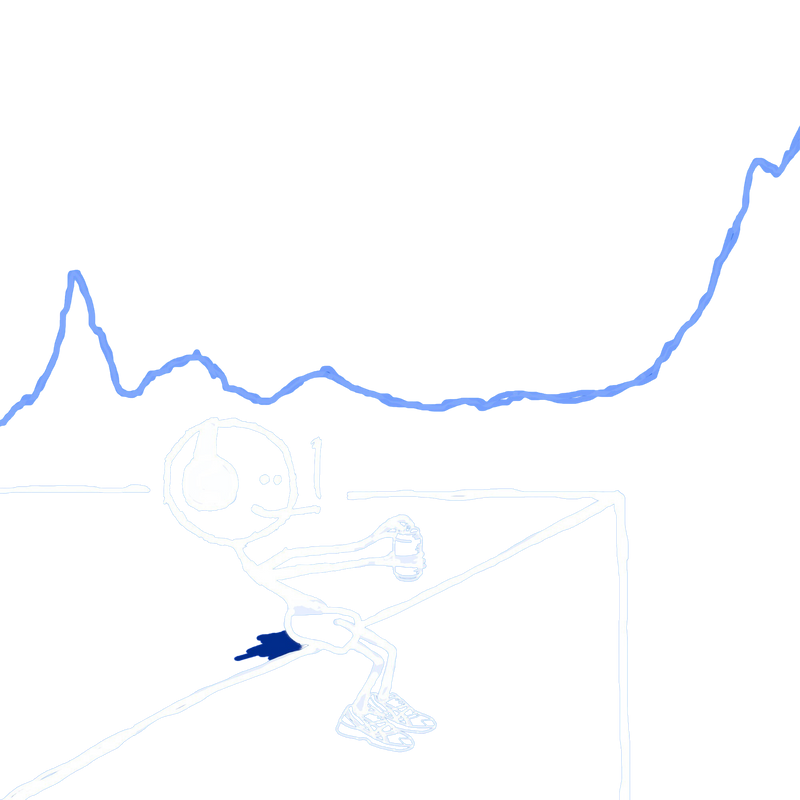

Join The Fight...

Modern times are stressful.

We face several real threats to democracy, and our options look unsuccessful.

Giving us a choice. We can face the interpersonal challenges ahead, embrace

the incoming technology shifts, and earn a place in the world of tomorrow...

Or ignore it all, and just sit back, while society continues derailing off track.

A future together could be so bright. But in order to fly, we must first learn to fight...

The

System

Network

Culture

Business

Currencies

Prospect

Multi-media

Poet

Enter your email to join our network. OG Membership available for a limited time.

*

Founding Principles

Blockchain opened the doors to a new future. It’s not run by governments, banks, or big companies, but by code. Code that allows us to trust each other, that’s reliable, and that lets us use our money as we see fit across our digital ecosystems.

We don’t need banks or credit cards to purchase things. There’s no middlemen pocketing a small percent for facilitating payments.

Rather than totally abandoning traditional systems, for now, blockchain is a way to hedge turbulent economic conditions. Governments can’t print more Bitcoin, but they can overspend. As blockchain continues being adopted, improved, and integrated into digital systems for public use, it serves as a rapidly developing and vibrant market for anyone who chooses to participate...

...and this is where the Ded Poet Society exists.

“You can send money to anyone, anywhere in the world, for little to no cost.

and within seconds, they can use that money. Do you see the potential?”

I. Decentralized, Free and Fair Financial Markets

II. Immense Strength of Boundless Communities

III. Empathy & Optimism

*cue scene

The System (is Dying)

abundant, unreliable, and perishable.

Yet, information about our identity and finances should be scarce, trustworthy, and permanent.

The internet was designed to move information, not value, from person to person.

So use powerful intermediaries (banks) to establish trust, maintain integrity and privacy, and move value. But the limitations, from speed and cost to operational capacity, hacker and supplier vulnerability, and risk of collapse, are increasingly evident. There are over a billion people who don’t even qualify for a bank account.

We abandoned the gold standard in the early 1970s, and since the purchasing power of $1 has diminished significantly. They are actively being debased. In 2008, quantitative easing began as a response to the financial crisis, and in response to the pandemic, the Federal Reserve printed $3.8 trillion in 2020, a 20% increase in the total money supply. It has since increased an additional $1.7 trillion.

Through traditional economic policies, the United States is now holds over $35 trillion of debt, with interest payments set to consume 76% of all income tax in 2024. We continue funding wars and face record high illegal immigration. We disagree on the solutions.

Leaving us with two choices. Augment our wages regularly while successfully investing in capital markets through times of heightened global tension (and pray we stop printing so much money), or be left behind. Those damn rich men north of Richmond...

But what if there was a third option? One that doesn’t depend on government spending, inflation, tax hikes, and a lifetime of racing the clock. One that cuts out vulnerable and greedy banks, and that was designed specifically for you, a standup person doing their best to lead an honest and happy life.

Walk with me, friend, as we explore the world of blockchain technologies.

The Prospect

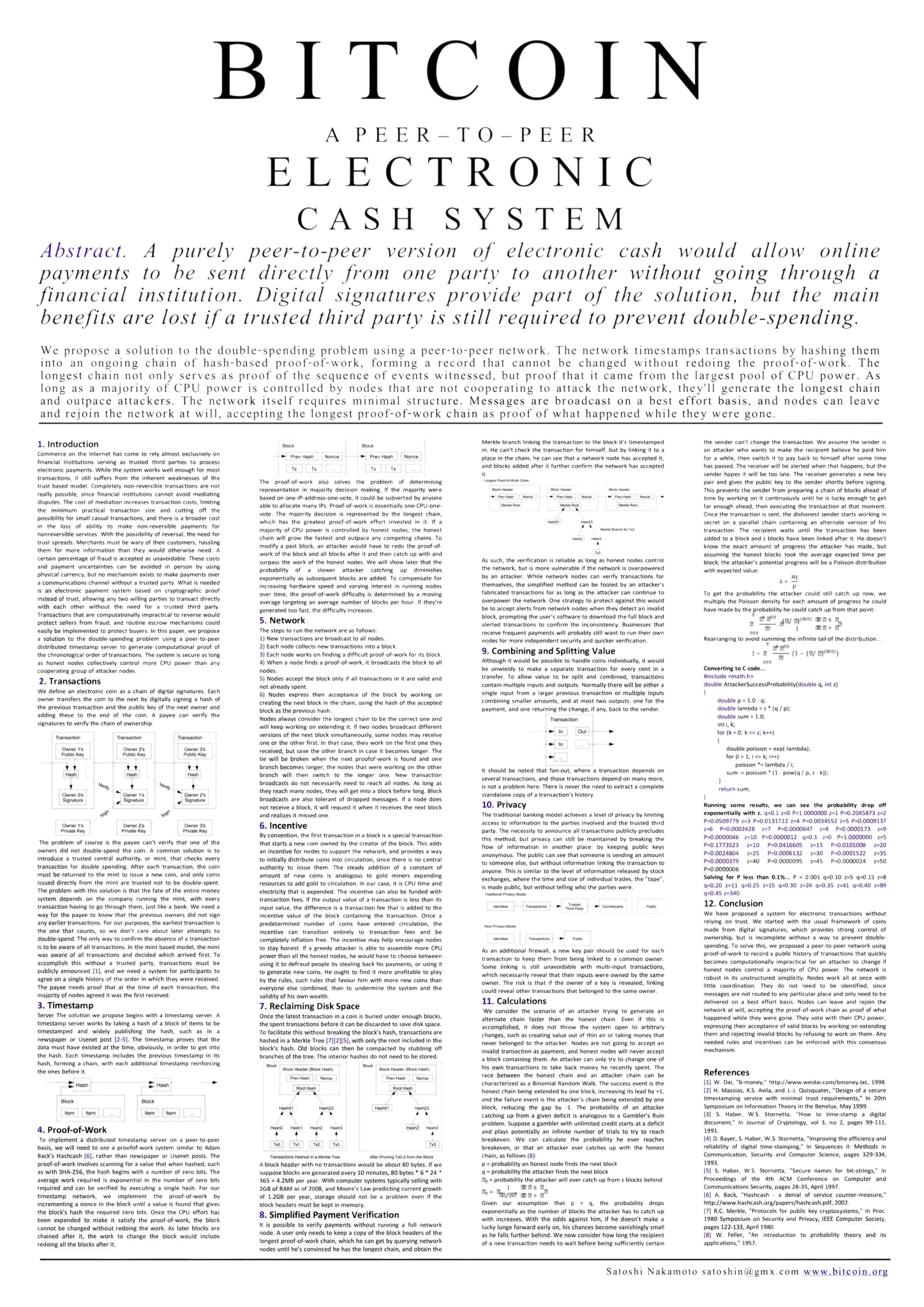

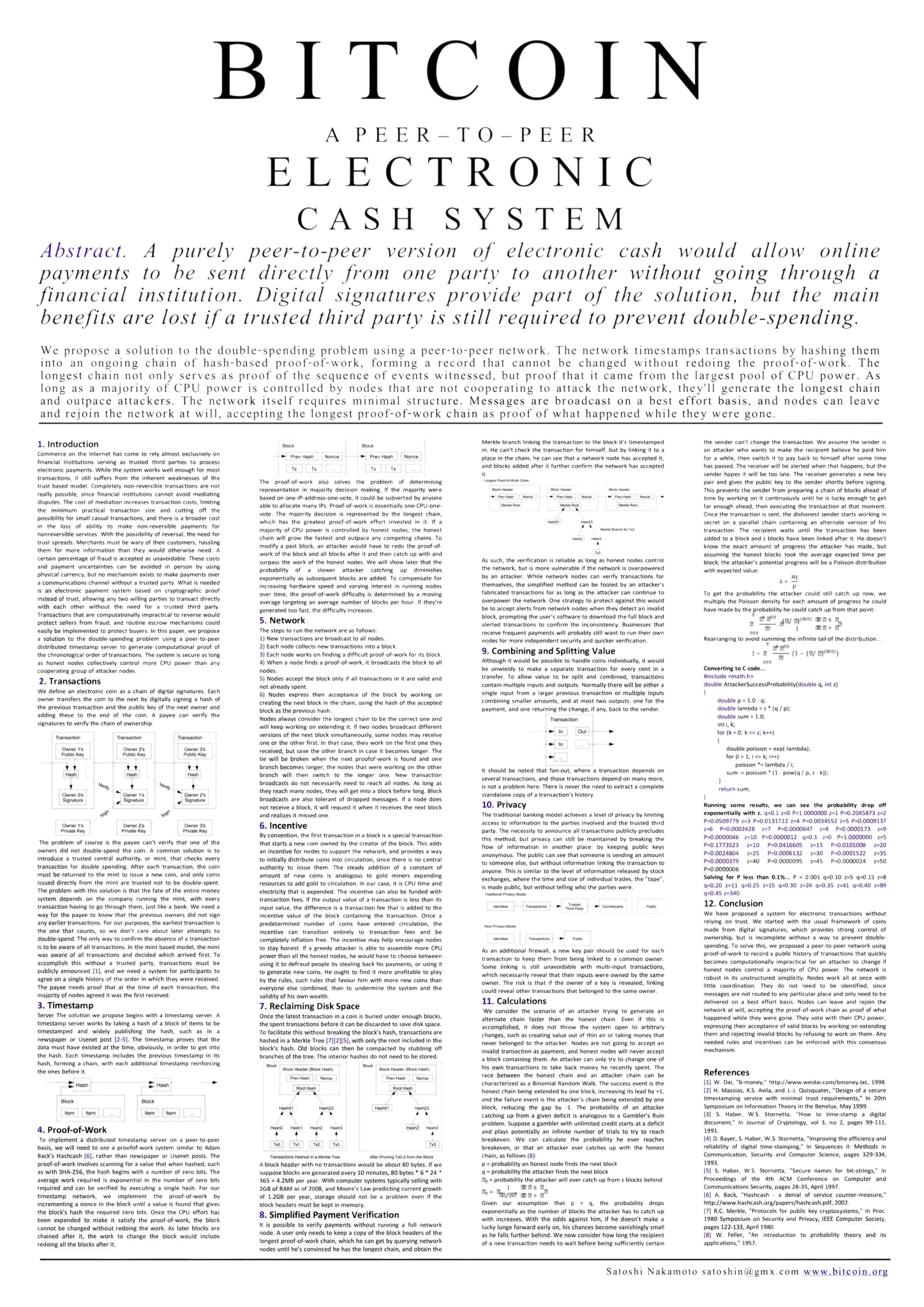

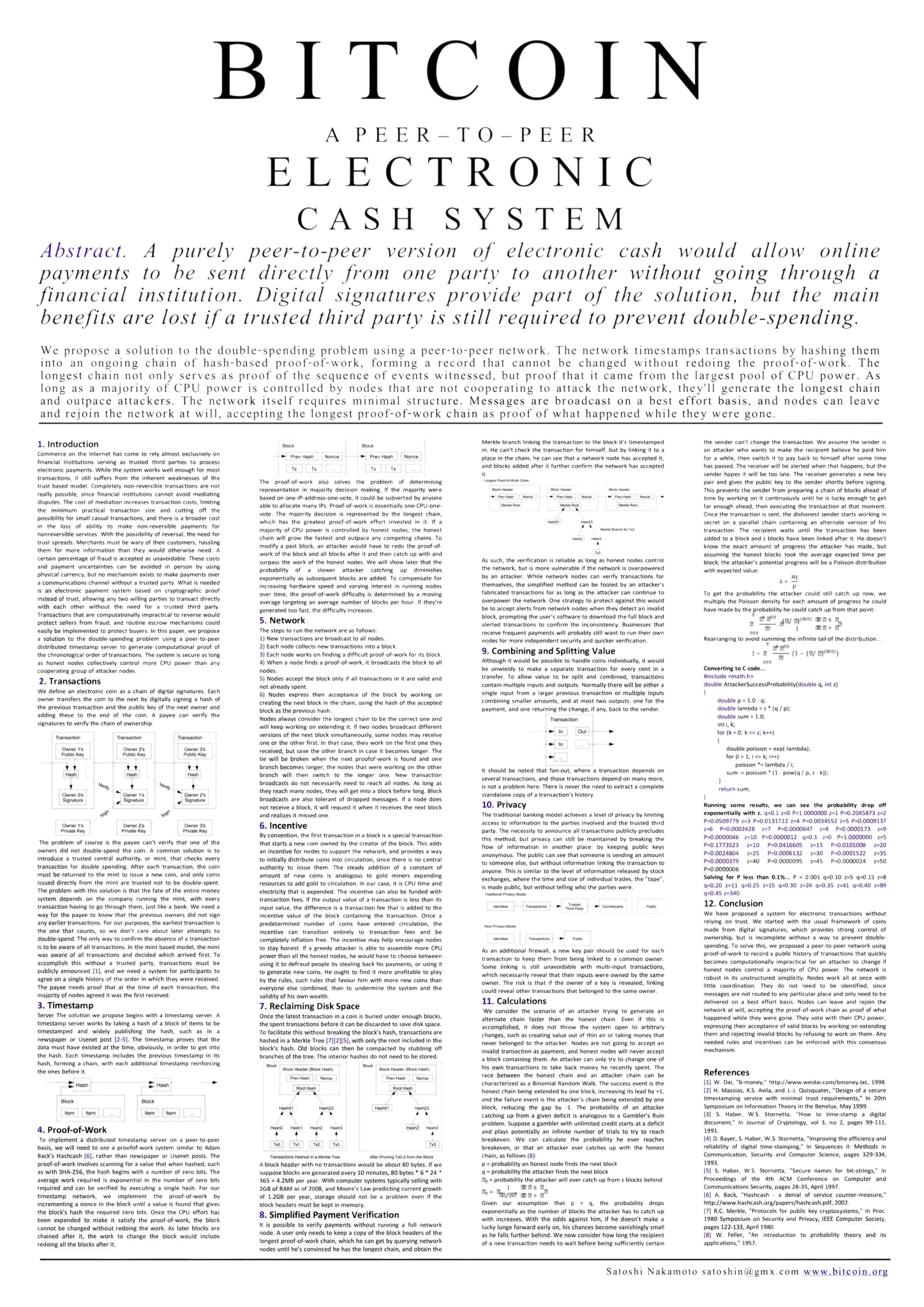

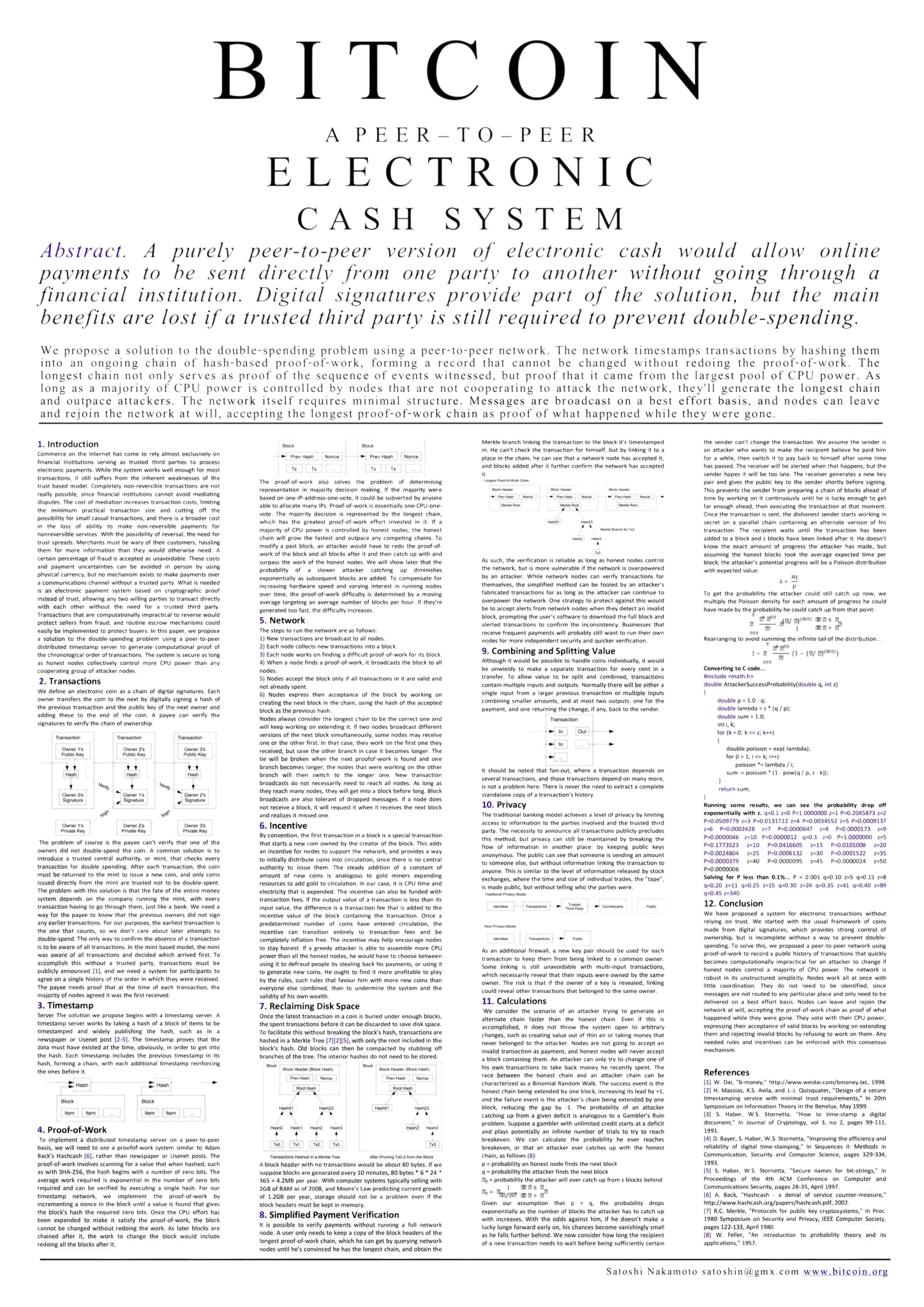

Just six weeks after Lehman Brothers filed for the biggest bankruptcy in U.S. history, on October 31, Satoshi Nakamoto released the Bitcoin white paper, detailing a digital financial network with peer-to-peer money transfers based on cryptography rather than trust. Through Bitcoin, with an ode to the original, decentralized ethos of the internet, Satoshi gifted the world blockchain technology. Thank you Satoshi.

A month into its operation, Satoshi posted:

“It’s completely decentralized, with no central server or trusted parties,

because everything is based on crypto[graphy] proof instead of trust... this is

the first time we’re trying a decentralized, non-trust-based system.” (Tatar 8)

It was evident Satoshi did not intend for Bitcoin to quietly integrate with existing systems, but rather, to replace the system entirely. A new system, free of top-down control, and fully governed by the decentralized masses. A direct threat to the traditional system of finance.

Understanding Bitcoin and blockchain technology is a demanding endeavor as there are quite literally millions of blockchains, participants, use cases, and terms. Our goal is to provide you a mental scaffolding you can use to explore whatever you’d like. Construct your scaffolding, then watch as it flourishes.

For now, all you need to know is:

Bitcoin is a digital, immutable public ledger that uses complicated math to establish trust between parties, allowing people to send money (Bitcoin) directly to other people without an intermediary. Bitcoin was the first ever blockchain technology.

Other than digital money transfers, one of Bitcoin’s main value propositions is its supply cap.

There will only ever be 21,000,000 Bitcoin. This cannot change. It’s in the code.

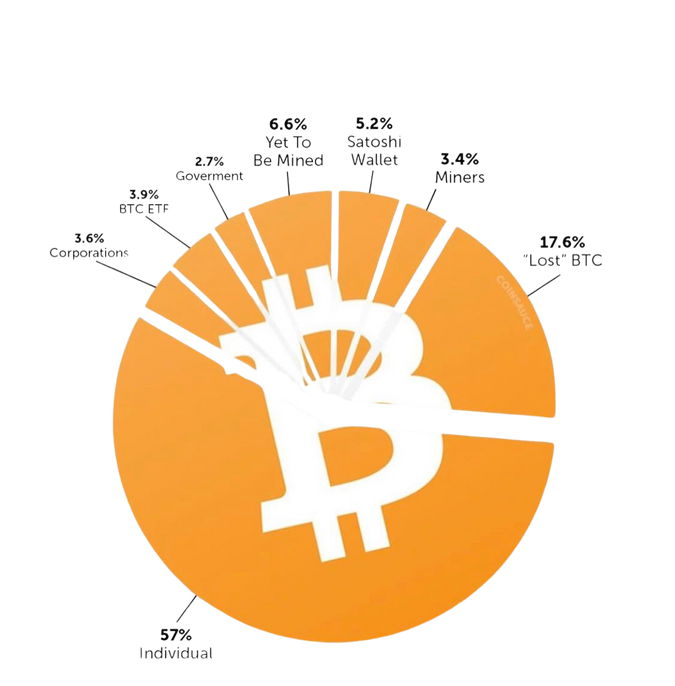

Over 94% of all Bitcoin is already circulating. By 2036, it will be 99%. The Bitcoin network will continue issuing Bitcoin to miners until 2140, meaning the final 1% will be issued over the next century.

So why do miners get the Bitcoin? Well, when users submit transactions (send money), miners compete to add this information to the blockchain. They use a combination of software and hardware in order to solve a cryptographic algorithm that is embedded in the network.

If successful, the miner generates a hash (64 digit alphanumeric code), and are rewarded with Bitcoin for correctly verifying and recording the transactions. The amount of Bitcoin they receive is cut in half every four years, known as the Bitcoin halving.

Happy miners create healthy networks.

Who holds the rest?

Mining isn’t essential knowledge,

but it’s good to have a basic understanding.

You can read more in-depth here.

Most mining is done by large private

corporations. The top 15 mining companies

collectively hold around 0.25% of all Bitcoin.

Bitcoin ETFs

The SEC approved 11 spot Bitcoin ETFs on January 10, 2024, and that number has since increased to 34 to begin Q4. While large, institutional buys have likely had a positive impact on price, as well as signal government adoption, Bitcoin was created to free individuals from these entities, and there is some risk of centralization and censorship.

Bitcoin operates with or without the approval of governments, though if owning Bitcoin was illegal, it would likely deter many holders.

Satoshi has 1.1 million, about 5.2% of the supply. The estimated 22,000 wallets storing it have long been dormant.

The recent Bitcoin ETFs gave access to private firms in a move that excited many yet is contrary to Bitcoin’s objective. And multiple governments including the US have sizable holdings (mostly through seizure from criminal activity).

But most Bitcoin is owned by individuals.

Distribution of Bitcoin, Q1 2024

As of Q2 2024, over half of all Bitcoin is owned by individual investors. The distribution seen in this chart fluctuates as more people learn about Bitcoin’s potential value. It has attracted strong interest through the BTC ETFs the first year of the BTC ETFs. In their first six months, these ETFS traded over 300 Billion dollars in volume and hold nearly 60 Billion dollars worth of Bitcoin. The Bitcoin ETFs rapidly became the second highest single commodity ETF by market cap behind gold.

Who is Satoshi Nakamoto?

There are hundreds of theories surrounding the identity of Satoshi Nakamoto.

Individuals who've claimed to be Satoshi have been disproved. Others claim tech giants Samsung, Toshiba, Nakamichi, and Motorola are responsible. That too is unconfirmed.

The truth is nobody knows, minus a select few and for the health of the network and its participants, it is best it stays that way. It’s likely Satoshi spent years formulating the concept prior to its release, as they guided Bitcoin through infancy in the proceeding two.

In the first ever instance of information recorded on a blockchain, Satoshi inscribed a message in January of 2009 stating banks were on the verge of a second bailout. This is the genesis to every blockchain implementation for the rest of time.

Just nine days later, the first Bitcoin transaction. Finally, in 2010, after advocating to keep Bitcoin payments off of Wikileaks, Satoshi vanished... and along with them, Bitcoin’s single point of failure...

Perhaps it is time

TFor us to evolve into

3

Web 1

Web 2

WEB

Originally a tool used by researchers to share data in the 1960s, the first version of the internet morphed in the early 90s when the first browser and internet protocols were developed. These enabled anyone with a computer and internet connection to view documents and pictures.

The next version, the one we use today, allows anyone with a computer and connection to interact with that content (think social media and messaging). The most valuable companies in the world are centered around internet use, whether theyre building devices you access it through, or the chips used in making them.

Web3 is the next iteration. Users and businesses are part owners of online entities, rather than the private companies. If the “next Google” is being built in web3, you can be an early investor instead of waiting for an IPO. Web3 refers to any technology, system, or online culture based on blockchain technology.

Payments, DeFi, Depin, RWA

Jump to Crypto

Onchain

Utility

Markets

Crypto

Fashion, Gaming, IP, Community

The World is Onchain... anyone can verify it. Seriously, go check for yourself. This is the smart contract address for a decentralized app called Uniswap that let’s people exchange crypto with each other. People traded $xxx last week.

Every transaction on a blockchain is visible, verifiable, and unmanipulable. It provides 3-part accounting while reducing the cost and decreasing the time of transferring money and value over the internet. Onchain refers to any operation, product, or service existing on a blockchain.

Over half of Fortune 500 companies have onchain projects and over half of small businesses are looking for crypto-native employees. Titans like Blackrock, Fidelity, JP Morgan, and Goldman Sachs are accumulating Bitcoin. Paypal, Visa, Mastercard, Apple Pay, Venmo and more added crypto payments just this year, letting you send and receive money without the usual fees and settling in seconds.

We grind like Sisyphus for PMF,

On this comet where code serves as the ref.

Cold-Blooded Contracts

The lifeblood of onchain activity is smart contracts. Smart contracts, like other contracts, include the terms of an agreement, except these are deployed onto a blockchain for anyone to agree with. They automatically execute when the conditions are met and the complete history of interactions is publicly available.

They enable developers to release dapps (decentralized apps). Dapps gave life to the DeFi (Decentralized Finance) protocols that have removed institutions and third parties from financial transactions, massively reducing cost at scale. They’ve unlocked the potential for huge efficiency gains in logistics and energy management. They are how we will buy, sell, and manage our in-game assets.

They are also being used to tokenize... well, everything. Skip to RWA.

Ethereum is currently the most used smart contract platform.

They’re Headed For The Stables!

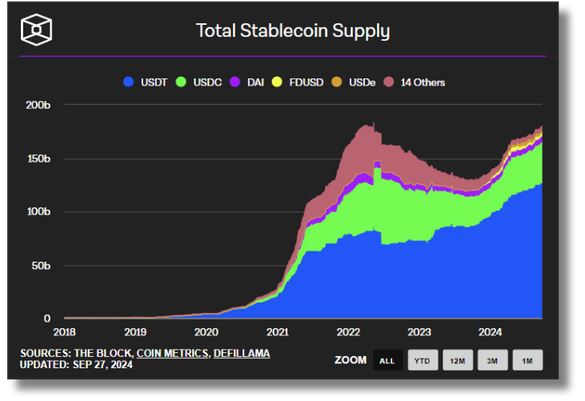

We may well be on the cusp of another mass adoption event and stablecoins will play a lead role.

Stablecoins are digital tokens backed by a stable asset, such as gold, USD, or another fiat currency. Tether (USDT) and USD Coin (USDC), the two largest stablecoins, are backed 1:1 with USD, meaning receiving 10 Tether or 10 USDC is equivalent to receiving $10. In theory, regardless of market conditions, you will always be able to exchange 1 token for 1 dollar.

Malpractice led to a few stablecoins depegging and collapsing in 2021-2022, but their value as an asset class has undergone huge growth. Tether outgained NVIDIA through the first half of 2024 and USDC is backed by a reserve held by BNY Mellon and managed by Blackrock. With the spotlight shining directly at them, it’s unlikely we’d experience a similar event.

Stablecoins. at their core, are digital dollars you can send, spend, and receive nearly instantly, practically free. Sending money to a friend abroad? Text them USDC and they’ll have the money within minutes, no middleman fees. Need a loan or want to lend? Use a centralized exchange like Coinbase or Binance or a DEX like Aave or Compound and set the terms to receive your USDC.

Just look at the supply of stablecoins. You can see they exploded in 2021, then after a slight pullback, the supply is rising again.

Stablecoins are usually held on a Layer 1 but sent over a Layer 2 chain, such as Base or Optimism. As opposed to Layer 1 chains, like Bitcoin, Ethereum and many more, Layer 2's bundle transactions for Layer 1's and execute them for little to no cost. When a lot of people try to send a transaction at the same time on a Layer 1, fees go up due to the limited block space. Layer 2s help them scale.

Name some promising Layer 1s and Layer 2 chains and specialties, Ton, Tron, AVAX, Ethereum, Solana, Base Optimism

$1T of crypto was traded every month this year.

If you feel like you’ve missed the boat, let us ensure you, the ship has barely left port. Bitcoin is the largest blockchain by market cap, but blockchain outside of Bitcoin, such as Ethereum, requires additional layers of understanding to communicate the value.

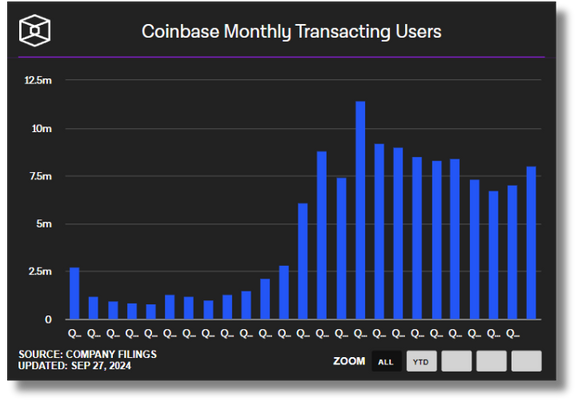

Historically, Bitcoin hitting new all time high prices leads to parabolic growth of onchain activity as word of the huge gains trickle into mainstream and social media. Once new buyers enter the ecosystem, some leave, but many find their way into different niches of web3. Mass adoption coming through stablecoins.

In the previous cycle, Bitcoin broke all time high, then Ethereum did, leading to the NFT craze, which are digital assets on the Ethereum chain. This cycle is likely to be similar, but Bitcoin’s price increase will not be the only thing onboarding millions...

In late 2009, the first ever exchange rate for Bitcoin was established at... 1,309 Bitcoin = $1

Satoshi’s gift of blockchain technology blossomed from a small, open set of cold code to enormously warm social networks. While there are a myriad use cases for blockchain technology including major overhauls to healthcare, insurance, polling, real estate, music, gaming, supply chains, charities, and law enforcement, to this day, we have barely scratched the surface in terms of integrating blockchain tech. into our systems. Much of the implementation will be centered around smart contracts.

Consumer Markets

In 2020-2021, we had the world’s first NFT craze. Seemingly useless and often ugly pictures that were part of larger collections saw speculative prices rise into the hundreds of thousands, and a few, into the millions. And consumer brands giants took notice. Nike, Adidas, Gucci, Tiffany, Budweiser, Pepsi, McLaren, Audi, and many more, all began development in this new territory of “web3”.

They saw an opportunity to create new revenue streams, through refreshing and innovative marketing strategies, with the goal of reengaging and growing their customer base. And brands weren’t the only ones. There were hundreds of professional athletes, musicians, and other celebrities who dipped their toes into the ecosystem and released projects for participants to purchase.

DeFi, Depin, Consumer Apps, Fashion, Gaming, IP, Community

Additional Resources & Keywords

Fashion, Gaming, Other

Moon or Rug?

coming soon

Runes

Crypto is...

Crypto Twitter

SocialFi

Altcoins

Digital Collectibles

Defi

Degens

Trade Analysis

DePin

Apes

Solana

Market Cycles

Liquidity Pools

Macro Setting

Security

MEV Bots

Story of FTX

Smart Wallets

Transactions

Gaming

Regulation

Mining

Bitcoin

Ethereum

Mass Adoption

Real World Assets

Layer 1

Memecoins

Layer 2

CEX vs. DEX

Your crypto experience will likely be short-lived if you do not understand basic wallet management. Managing your smart wallet(s) is foundational to safely exploring anything crypto. If you already know this part, or live recklessly, by all means go ahead.

The next five minutes of learning can save you years of hard work. Work smarter, not harder.

- Smart Wallets

In order to buy, sell, hold, or swap crypto, you need a smart wallet. Smart wallets store your private keys which it uses to securely sign transactions when you submit them.

Until recently, setting up a smart wallet was difficult. The process included downloading an app, creating a password, storing your seed phrase (used to recover your account), and linking bank account information (then wait a few days before transacting). Tedious.

But recent improvements have made the process seamless. Coinbase’s new smart wallet eliminates... all of that. See for yourself. The new era of smart wallets uses your biometrics as your password, and you can buy and sell crypto instantly using a credit or debit card.

- Custody vs. Self-Custody

Hot vs. Cold Wallets

You may have heard the term “cold storage” before. This refers to a cold, or hardware wallet. Hardware wallets are physical devices that store your digital assets safely offline. To transact with them, they must be plugged in and you physically hit confirm.

Hot wallets, on the other hand, are software-based and stay connected to the internet. Housed in an app or web-extension, these wallets are optimal for frequent trading.

Hot wallets are inherently more prone to phishing and malware, which is why it is good practice to keep high value assets on a hardware wallet. A two-factor authenticating app (not text-based) is a great tool to keep your assets safe wherever they are.

*when your hardware wallet is plugged in and you are transacting, it’s a hot wallet!

- Transactions

Clicking submit on a transaction will raise your blood pressure.

“Did I double and triple check the receiving address? Am I sending tokens over the correct network? What is this approval message? What is slippage?”

When we use credit cards, we don’t worry that our funds might go to the wrong place.

But sending crypto’s a little different, especially when away from a CEX.

So below is a list of worst case scenarios and how you can avoid them.

If you... | Result | How to Avoid |

send your crypto to the wrong address. | It is irreversible. Your crypto is likely gone forever. | You should always copy and paste wallet addresses, they are too long to manually enter. Once done, double check the first few and final four digits to ensure consistency. |

send your crypto over the wrong network. | Usually irreversible. Your crypto is likely gone forever. | Bitcoin is traded on the Bitcoin network. Ethereum on the Ethereum network, and Sol over the Solana network. There is more nuance with altcoins, but ensure the crypto you’re sending is on the same chain as your network. |

unknowingly connect to a phishing site and submit a transaction. | You will be drained of every asset on that wallet. | Trust nothing and no one who hasn’t proven themselves a good actor. 10/10 times it sounds too good to be true, it’s a scam. Nothing is free. Tons of social engineering scammers that will tempt you in DMs, social media posts, and group chats. If you realize you did, immediately go to revoke.cash and revoke all permissions. Then, move every asset of value to a different wallet. |

are persuaded to buy the “next 1000x” and it crashes to 0 a few days later. | Take your loss and move on, no one is bailing you out. | Follower count does not equal trustworthiness. Many big names have grown their following through various forms of grifting, and there is a long list of celebrity tokens and projects left completely abandoned shortly after launch. There is a miniscule list of success stories. |

The number one way to avoid these mistakes is to avoid hasty decisions.

Be patient, stay calm, stay vigilant.

Experienced people can make reckless mistakes when rushing.

Take your time, and ensure everything looks right before clicking submit.

The final topic to address before getting to the good stuff is security. After all, the years of research and thousands of dollars people invest is only as good as their wallet security. Yes, they retain much of the knowledge and learn new lessons.

People get drained all the time, and while sad to see, it’s crushing to experience.

single act of naivety or vulnerability is all it takes for someone to exploit your holdings. It happens all the time. While most who’ve participated in the space for several years are usually able to easily spot scams in whatever form they appear, this does not hold true

- Security

for newcomers.

Chat moderator job paying $800/week? Salaried beta tester for a new game? Giveaway winner? Account with thousands of followers but very little and inorganic engagement?

These are all malicious scams created in an attempt to drain your wallet.

When entering the space, it is best to have someone you trust show you how to operate. We all start at the same point, and many people are happy to educate others about how it all works.

Bitcoin

Our section on Bitcoin lays the foundation for its origins, value, and future. Over the past year, in the background, many of the world’s largest institutions have been accumulating. Hedge funds, banks, state treasuries, huge companies have all added Bitcoin to their balance sheet. A US Bitcoin Strategic Reserve has been discussed. And as the grueling months of SEC enforcement and mixed political rhetoric pass, Bitcoin, crypto, and blockchain is seeing more and more bipartisan support.

Paul Pierce, Kevin Garnett, and Ray Allen... whoops. Bitcoin, Ethereum, and Solana.

We discussed Bitcoin in length here, so let’s talk about the other two.

The second largest cryptocurrency by marketcap is Ethereum. It first went live in 2015 and has since become a powerhouse of an ecosystem. Blackrock RWA investment. Transition from PoW to PoS. Lagging price action. Digital oil, digital computer.

Deflationary vs bitcoin inflationary

Outcompeted in innovation while focused on Layer 2's and infrastructure.

Solana, the land of the jeets. Tons of innovation. Best large cap to hold thus far.

Stiffest competition as fastest and cheapest chain as developments occur daily. Largest current threat is Toncoin. Time will tell if Solana can hold its place at the top.

All time charts of all 3

Altcoins

While inherently riskier because of their lower market caps and undelivered promises, altcoins have historically been where the largest gains are made.

Altcoins can be anything from Gaming tokens to AI infrastructure to layer 1s designed for different purposes.

Discuss few altcoins.

Most altcoin charts grim outlooks as liquidity has been flowing into memecoins and away from high float, low FDV.

- Regulation

The acceptance and regulation of cryptocurrencies varies greatly between countries. However, there is an accelerating trend of adoption among governments and investment funds. The approval of the BTC ETFs signaled a potential shift in policy for the US, with presidential candidates now developing (or attempting to) public stances towards crypto self-custody and access to markets. While FIT21 saw bipartisan support and passed both the House and Senate floors in May, it was eventually vetoed by Joe Biden. ETH ETFs just this summer. Both China and Russia have stated they plan to legalize crypto mining and payments in Q4 of 2024.

Memecoins

Memecoins are not new. In fact, Dogecoin was released on its own blockchain a full year before Ethereum.

But the attention they’ve received over the past year is undeniable. Many attribute recent interest to a new Pepe token reaching a 1.6B market cap in just 19 days in Q2 of 2023, a sign of what was to come. Next fastest was 263 days by Shiba Inu (verify)

Memecoins do not offer utility in the usual sense of the word. They do not revolutionize payments, or data management, or security. And they are often released on existing chains.

What they do offer is community, laughs, and memes. In a world of increasing unknowns and a sentiment of helplessness, people cherish belonging. They cherish being around like-minded people. They cherish being validated. They crave dopamine. Memecoins are tokenized internet culture. It was common in the NFT craze of 2021 for projects to tout their community prowess. “#1 community in web3.” “Nothing but diamond hands and gigachads.” However, most projects at the time failed to understand the true power of community.

- Adoption

We touched on institutional adoption above, but the elephant in the room is the adoption by regular people, by retail. Mass adoption.

After observing the space (in the trenches, if you will) for several years, it is clear that most crypto participants believe in the fundamentals of blockchain technology to disrupt the world. Whether through the fiat hedge of holding Bitcoin, instant and practically free cross-border money transfers, or the verification of online data and ownership, blockchain is poised to disrupt... a lot.

They may choose to participate in the market in diverse forms; sat stacking, code-learning, making art, joining communities, airdrop farming, memecoin gambling

There are very few people who have spent the time required to understand Bitcoin’s value and do not build up their holdings.

- Digital Collectibles

Crypto Twitter

CT. Where do we even begin?

A place where you will simultaneously be called a disgusting incel-simp and among the first to learn about the next big launch.

Influencers vs celebrities

We go more into culture here

Terminology

Decentralized

Decentralization refers to any network or system’s control that is spread across many touch points.

Web3

The colloquial term for any aspect of crypto or blockchain. Internet ownership.

Gas

Gas is the fee required to execute a transaction on a blockchain. In general, the busier the network, the higher the fee. The fee is also dependent on the chain (some are more expensive than others).

Layer 1

Layer 1's (L1) are foundational blockchains. They must include a protocol (how they’ll function), a consensus mechanism (network safety and security), and native cryptocurrency.

Bitcoin, Ethereum, Solana, and thousands of others like Doge, Ton, and Avalanche are all L1s.

Layer 2

Layer 2 blockchains (L2) increase the efficiency and functionality of Layer 1's. When networks grow sufficiently large, transactions take longer to process and are more costly to execute. So Layer 2's help them scale. The most common types of L2's are bridges that process transactions away from the main chain then upload them, and zero knowledge roll-ups.

CEX

A CEX is a centralized exchange, such as Binance or Coinbase. These exchanges offer many, but not

all, cryptocurrencies for you to purchase. They custody your crypto until you choose to send them elsewhere. They are the safest place to hold your crypto to protect against scams.

However, there is a saying in crypto, “Not your keys, not your coins.” This refers to the fact that CEX’s do not actually buy the crypto you select. They sell you a promise that the value is there. If an exchange experiences downtime, or decides to limit your account, or declares bankruptcy, you are at risk of losing your investments and there is not much you can do.

DEX

A DEX is a decentralized exchange, such as Uniswap or Sushiswap. You can purchase practically any cryptocurrency through peer-to-peer trading, a core tenet of crypto. Unlike CEX’s, crypto is purchased exclusively through swapping crypto for crypto. DEX’s are the main source of trading for Defi, as it also includes options like limit orders and margin trading.

Consensus Mechanism - Proof of Work

Consensus mechanisms are required to incentivize integrity among the operators of blockchain networks. Around 60% of blockchains including Bitcoin utilize Proof of Work, which is designed to make computers complete complicated math, therefore proving they did “work”.

Consensus Mechanism - Proof of Stake

Proof of Stake takes a different approach, requiring validators on the network to stake a certain amount of their native crypto. This makes it more difficult to attack as the honest workers of the network are incentivized to hold more crypto (making the price to overthrow much higher).

Cryptography

Layer 2 blockchains (L2) are built to increase efficiency or functionality of existing L1s.

ETFs, or Exchange Traded Funds, are a type of security that tracks the performance, or price, of an asset or commodity. In this case, Bitcoin’s price. By holding an equivalent amount of Bitcoin per share, the fund itself is backed by Bitcoin.

Liquidity Pools

Layer 2 blockchains (L2) are built to increase efficiency or functionality of existing L1s.

Node

Layer 2 blockchains (L2) are built to increase efficiency or functionality of existing L1s.

Validator

Layer 2 blockchains (L2) are built to increase efficiency or functionality of existing L1s.

RWAs

Layer 2 blockchains (L2) are built to increase efficiency or functionality of existing L1s.

- ICO vs. TGE

- MEV Bots

- Snipers

- Bull versus Bear

- KOLs

- FUD

- Self Custody

- Degen

- Ape

- CTO

- Jeet

- “in the trenches”

- jfc

- NFTs

- Chad

Resources

Arkham, The Block, X, etherscan.io, solscan.io, Magic Eden, Coin Gecko, Tradingview, Dexscreener

The following is a list of components to crypto. You do not need to know them all, but familiarizing yourself with these will aid you on your explorative journey into the world of digital ownership.

Coming Soon...

RWAs

Market Cycles

Trading Analysis

Ordinals & Runes

Journey into the Crypto Mines

Culture

Crypto culture has drastically changed since inception. Originally hackers and nerds fighting to change the system. Now 560 million participants.

You can’t define it, you just have to experience it. Compared to Wild West and that’s not far off.

Memetic Magic

With great power comes great responsibility

Degeneracy

Hyper gambling, xenophobia, nonstop FUD.

Crypto and web3 have a serious degeneracy problem.

Do you or someone you know have information regarding the owner of this meme?

Report anonymous tips to

1-800-MEME-JAIL.

WANTED - Dead or Alive

The Business

dedpoets@gmail.com

Consulting

Our founder, Tommy Flowers, is available for part or full-time consulting and research positions. Please send inquiries to dedpoets@gmail.com.

Education

Ded Poet Society is looking to offer online and in-person educational experiences. Tommy is a licensed Teacher in MA and has taught several clubs. We are looking for K-12 and university partnerships. Please send an email to dedpoets@gmail.com for more details.

Products

The core team at Ded Poet Society has developed several products that you will find below. If you are interested in learning more, or aiding their development, please reach out via one of our channels.

Newsletter

All the drama of Crypto Twitter and more, minus the time.

Recapping news and roasts twice a week, all for the price of a dime.

Online Clubs

We teach technical basics and character too, let us impart some wisdom on you.

Project-based learning to hone our skills, designed for anyone, not just a few.

Children’s Books

Poetic stories for kids to enjoy, but there’s lessons in there for all..

The kids will have fun but you’ll begin to understand crypto’s technical wall.

Board Games

Original designs and unique mechanics, born from a love for gaming.

Competitive or casual,

And alas, the poet will take off his mask.

The vision is clear, nowmore task.

But do not be so quick to think,

He is bereft of one last wink...

Tommy Flowers

Tommy Flowers has a B.S. in Mechanical Engineering from the University of Rochester. After four years learning, investing, and forming relationships in web3, he has pivoted to working full time in blockchain. Prior to DPS, he was a high end project manager and engineer in Boston and New York, before teaching for a year in public schools. He served as the Community Manager for a blockchain-based strategy game in 2022, and Senior Director for a web3 consulting and investment firm.

The Poet

Through several startup and global experiences, Tommy’s love for people has solidified. Ded Poet Society is his calling to merge his passion for emerging technologies with his goal of helping others. Much of his work is centered around uplifting underserved communities and people, and he sees blockchain technology as a perfect medium for building out value.

Tommy Flowers is a pseudonym.

Favorite Crypto

$BTC, $ETH, $PEPE, $BOBO

Favorite NFT Projects

Jirasan

The Plague

Kitaro World

Mfers

Rare Pepe